Industry Circular on the Application of FEDRs for Purpose of Computing Platform Workers’ CPF Contributions and WIC

Objective

1. This circular is to inform the industry of the application of FEDRs for the purpose of computing CPF contributions and WIC for PWs1, which will be implemented in the second half of 2024. In summary,

For private hire car and taxi drivers

a. The FEDR set at 60% for tax purposes will be used to compute CPF contributions and WIC for all ride-hail income that is considered platform work.

For delivery riders

b. The FEDRs of 20%, 35% and 60% will be used to compute CPF contributions and WIC for PWs who are using non-motorised transport, 2-wheel motorised a transport and 4-wheel motorised transport respectively.

Background

2. In November 2022, the Government accepted the recommendations of the Advisory Committee on PWs (“Advisory Committee”) to strengthen protections for PWs. The recommendations, which will be implemented in the second half of 2024, include recommendations for PWs to boost their CPF savings for housing and retirement adequacy, and to ensure adequate financial protection for PWs in case of work injury.

3. The recommendations include that the PW’s total earnings less expenses (net earnings) should be used to compute their CPF contributions, and to determine the PW’s income loss compensation and lump sum compensation for permanent incapacity or death, for purposes of WIC. This Circular sets out how the PWs’ net income will be determined using the FEDRs for the purpose of computing CPF contributions and WIC.

4. The application of FEDRs for computing CPF contributions and WIC for PWs will streamline processes for Platform Operators (POs) while providing convenience for PWs.

FEDRs to apply based on PWs’ mode of transport

5. With reference to the FEDRs that were developed by IRAS for tax purposes, the following FEDRs will be used to compute the CPF contributions and WIC for PWs based on their mode of transport:

|

Mode of Transport

|

FEDRs for CPF and WIC

|

|

Cars, Vans, Lorries, Trucks

|

60%

|

|

Motorcycles, Power-assisted Bicycles, Motorised Personal Mobility Devices

|

35%

|

|

Bicycles, Walkers (including use of public transport)

|

20%

|

Applying the FEDRs for CPF and WIC for all PWs

6. The FEDRs will apply for CPF and WIC purposes for all PWs, even if they do not opt in to boost their CPF savings2 or are not eligible to use FEDRs for tax purposes.

7. For purposes of WIC, compensation will be based on the PW’s total earnings from the platform sector in which injury was sustained, referencing earnings up to 90 calendar days before the date of accident. POs will provide information on net earnings (i.e. gross earnings minus the FEDR) to the WIC insurer, who will compute the compensation.

No adjustment will be made based on PWs’ declared expenses

8. The computation of CPF contributions and WIC using FEDRs will not be adjusted even if PWs declare a different expense ratio from the FEDRs for tax purposes. The FEDRs are expected to cover the expenses for a vast majority of workers. Applying the FEDR also reduces the administrative hassle for PWs to submit receipts to CPFB monthly, which in turn streamlines the process for both PWs and POs.

9. The application of FEDR for CPF contributions and WIC differs from FEDR for tax purposes in the following ways:

a. While PWs may choose to declare the actual amount of allowable expenses for tax purposes, the computation of CPF contribution and WIC will be based on the FEDRs at para 5.

b. The FEDRs will apply for CPF contribution and WIC for PWs of all incomes and across all modes of transport. For tax purposes, the 60% FEDR applies to private hire car and taxi drivers, while the FEDRs for delivery riders only apply to those who earn up to $50,000 annually from delivery work and exclude delivery riders who use private cars, trucks and lorries for delivery work.

c. For more information on the application of FEDRs for tax purposes, please refer to IRAS’ website.

Illustration on how FEDR will apply for CPF contributions

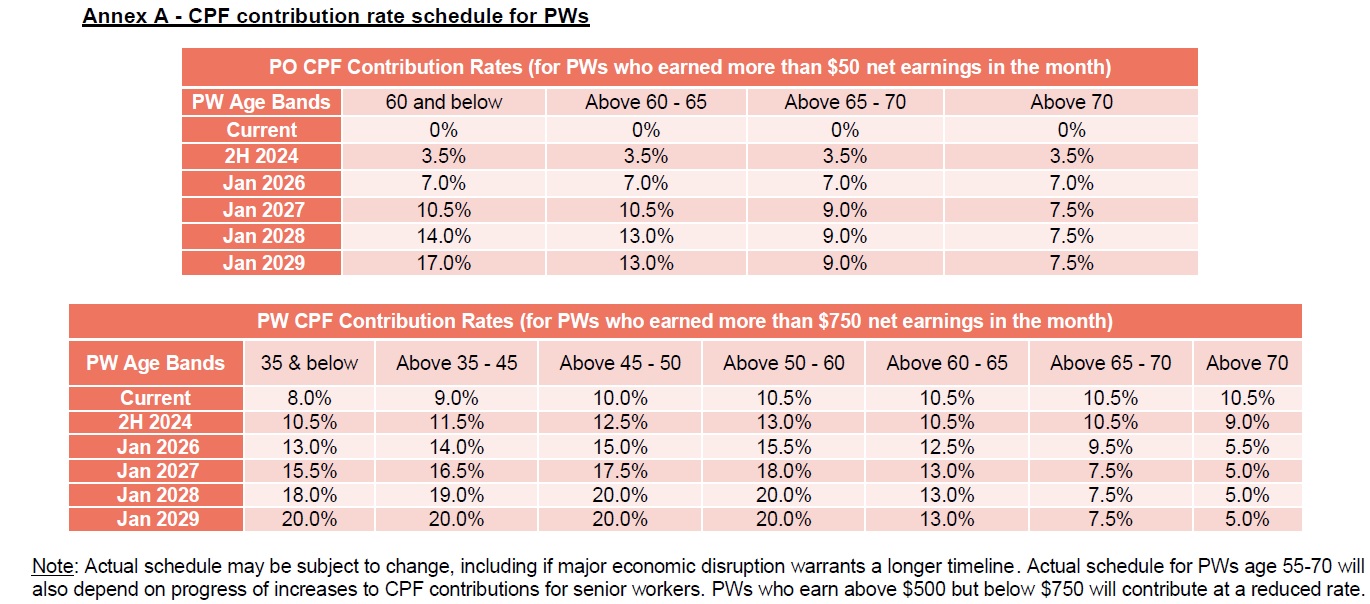

- CPF contribution rates vary with age and will be phased in progressively from 2H 2024 to 2029 (refer to Annex A).

- PW A is 25 years old in Jan 2025.

- PW A works as a food delivery rider (uses a motorcycle).

- The CPF contribution for PW A in the first year of implementation is as follows:

|

Gross earnings

(monthly)

|

FEDR

|

Net earnings

(monthly)

|

Total contribution3

(monthly)

|

PW’s share of CPF contribution4

(monthly)

|

PO’s share of CPF contribution

(monthly)

|

| $1,800 |

35% |

(1-0.35) * $1,800 = $1,170

|

$1,170 * 14% = $163.80 = $164

(rounded off to nearest dollar)

|

$1,170 * 10.5% = $122.85 = $122

(rounded down to nearest dollar)

|

$164 - $122 = $42

|

Illustration on how FEDR will apply for WIC

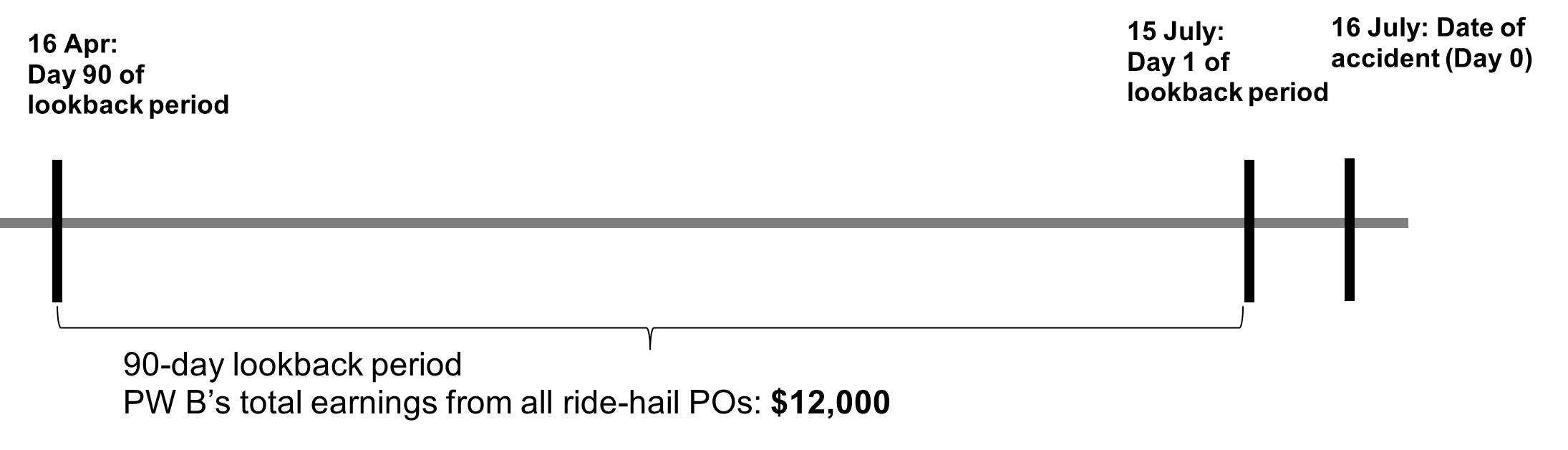

• PW B, a ride-hail car driver, sustained a work injury on 16 July.

PW B’s gross earnings from all ride-hail POs he had worked for in the past 90 days from 15 July (Day 1) was $12,000.

• The FEDR of 60% for cars will be applied to PW B’s gross earnings ($12,000) to derive the net earnings.

• The net earnings will be used to calculate the average daily earnings over the past 90 days before the accident (i.e. net earnings ÷ 90 days).

.png)

• PW B was issued hospitalisation leave for 14 days to recuperate.

• PW B would be eligible for income loss compensation based on the average daily earnings and number of hospitalisation leave days.

.png)

Contact Information for Clarifications

10. For clarifications, please contact the following representatives:

a. FEDR application for CPF: Brandon Nui (brandon_nui@cpf.gov.sg); Ng Lin Kai (Ng_Lin_Kai@mom.gov.sg)

b. FEDR application for WIC: Leon Poh (leon_poh@mom.gov.sg)

FOOTNOTE

1This applies to PWs who provide point-to-point transport and delivery services.

2POs will be required to collect PWs’ CPF contributions, including MediSave contributions for PWs who do not opt in. FEDR will be used to compute the MediSave contribution amount.

3Total contribution shall be rounded off to the nearest dollar. This means that an amount of less than 50 cents should be rounded down to the nearest dollar, while an amount of 50 cents and above should be rounded up to the nearest dollar

4The PW’s share of CPF contributions should be rounded down to nearest dollar