Reading time: 4 mins

At a glance

- Enhanced medical insurance for your helper offers higher coverage limits.

- It better protects you against paying potentially large medical bills.

- Unexpected medical conditions or emergencies can happen – switch to enhanced medical insurance now for peace of mind.

As an employer of a migrant domestic worker (MDW) in Singapore, you are responsible for her well-being, including her medical expenses. However, are you adequately prepared for medical emergencies?

From 1 July 2023, all new medical insurance (MI) policies, renewed policies, or extended policies for your MDW must meet enhanced requirements to better protect you against large medical bills in case of the unforeseen.

The most important change to note is how the coverage limit will increase from $15,000 to $60,000 with 25% co-payment by employers for claim amounts above $15,000.

You can remain on your existing $15,000 MI policy until it expires. But do consider switching to enhanced MI now for better peace of mind.

- All MI policies, renewals or extensions for MDWs that have a start date effective on or after 1 July 2025 will be required to have:

- Standardisation of allowable exclusion clauses to provide clarity on MI coverage;

- Age-differentiated premiums to keep costs affordable; and

- Direct bill reimbursement from insurers to hospitals.

Medical bills could become larger

It’s essential to note that MDWs are charged more at Singapore’s public hospitals, like other foreigners. More than 5% of bills incurred exceed the pre-enhancement $15,000 coverage limit, which could place a significant financial strain on employers. Imagine having to shelve important plans, or delay a major purchase because of unexpectedly high medical costs for your MDW.

As medical costs rise, this proportion may increase. Insurance policies with enhanced coverage will help employers like you minimise out-of-pocket expenses. We estimate that over 99% of bills will fall within the new coverage.

Why you should switch now

Don't wait until the last minute. Medical emergencies can happen to your helper at any time and when you least expect it. Having better coverage for your helper earlier ensures that you’re better prepared for emergencies, both financially and emotionally as a large medical bill can be highly distressing.

Switching now also means you’ll avoid last-minute hassles, complications and potential policy lapses.

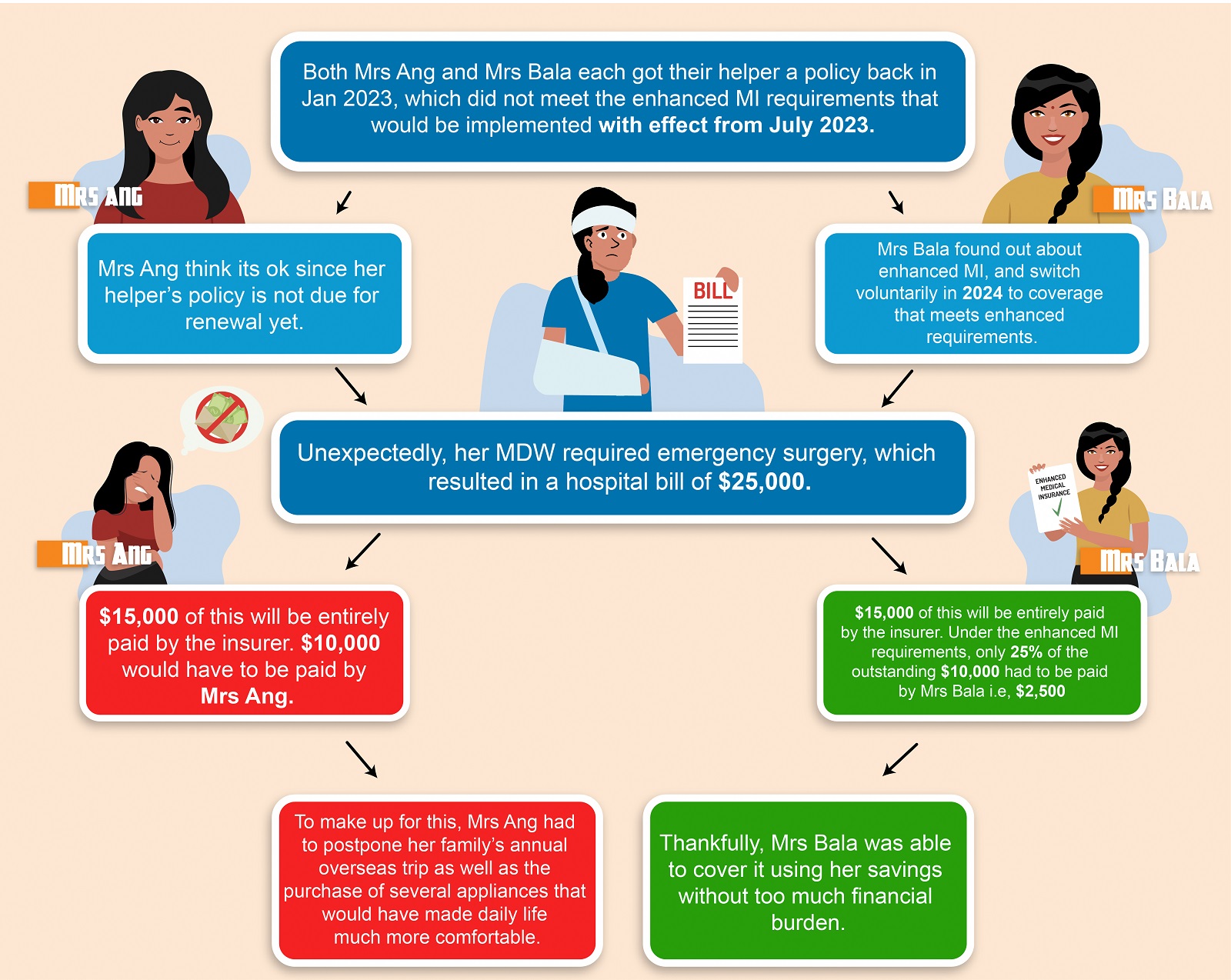

With and without the enhanced MI - two outcomes

Still hesitating about switching? Let’s have a look at two hypothetical scenarios that will help you see the benefits of enhanced MI.

How to switch

Contact insurers that offer enhanced MI to discuss your options. They can help you find the best policy based on your needs and budget.

By switching now, you will have greater peace of mind from knowing that your MDW enjoys better coverage. Why wait until it’s too late?