Reading time: 8 mins

At a glance

- Your helper’s salary is hard-earned money and meant to support herself and her family back home.

- She may end up overspending or having no savings for urgent financial needs if she doesn’t manage her money well, and this could lead her to borrow from unlicensed moneylenders (UMLs) with serious consequences.

- Knowledge of needs vs. wants, budgeting and goals can help improve her financial well-being.

Migrant domestic workers (MDWs) work hard for their salaries. Their salaries go to supporting themselves in Singapore as well as their families back home. However, unexpected expenses or poor budgeting can lead to overspending, which could lead to debt or could even make her vulnerable to loan scams and borrowing from UMLs.

Discover how you can empower your MDW with financial literacy, putting her on the path to financial well-being. Being financially stable enables her to focus on working for your household and not money-related worries.

MDWs may face challenges with money

Even if your helper knows that saving is important, many factors could make it difficult for her, including:

- Improper tracking and management of expenses

- Lack of financial literacy

- Not having the habit to save

- Pressure to send money to her family

Additionally, impulsive spending can be a concern too, especially during festive seasons when she may feel an urge to get gifts for her family back home.

Understanding overspending

One of the major causes of overspending is not understanding needs and wants.

Need

Something she and her loved ones require to function properly, like food and toiletries.

|

Want

A nice-to-have. This includes jewellery or new toys for her children.

|

While she can’t run away from spending on needs, spending too much money on wants means that she would have less money left to save for sudden financial needs or meet her current needs. This can have serious consequences:

Debt

If she overspends, she may turn to borrowing. This becomes a serious issue if she turns to UMLs (also known as "Ah Longs" or loansharks). In addition to charging very high interest rates that make it hard for her to pay off debts, they may also harass your household to collect money from your helper, or try to force you to pay off her debts.

Let your helper know that if she borrows from such moneylenders, she will risk harassment from them. In addition, she is liable to have her work permit will be revoked and will be barred from working in Singapore.

What you should do if your MDW borrows from UMLs

Report the matter to the police and the Ministry of Manpower immediately. Do not accede to the demands of the unlicensed moneylender in any way.

Taking on work that’s not allowed

Your helper may feel pressured into taking on a part-time job or starting her own business. These are not allowed for Work Permit holders, and also leave her with less energy for her responsibilities to you.

If you’re thinking about asking your helper to help out at your business so you can pay her extra, do not do so. This is considered illegal deployment, and penalties include a fine of up to $10,000 as well as a possible ban from hiring helpers.

Vulnerability to loan scams

MDWs under financial pressure are easily targeted by online scammers promising quick loans with low interest rates.

If she receives a text message offering loans and asking her to transfer a sum of money as a deposit beforehand, it’s likely a scam. Warn her about it.

How to beat overspending

The good news is that acquiring basic financial literacy can make a big difference to your MDW. As her employer, you’re someone whom she sees almost every day and trusts, which means that you’re in a great position to guide her along. Share this useful five-step guide with her!

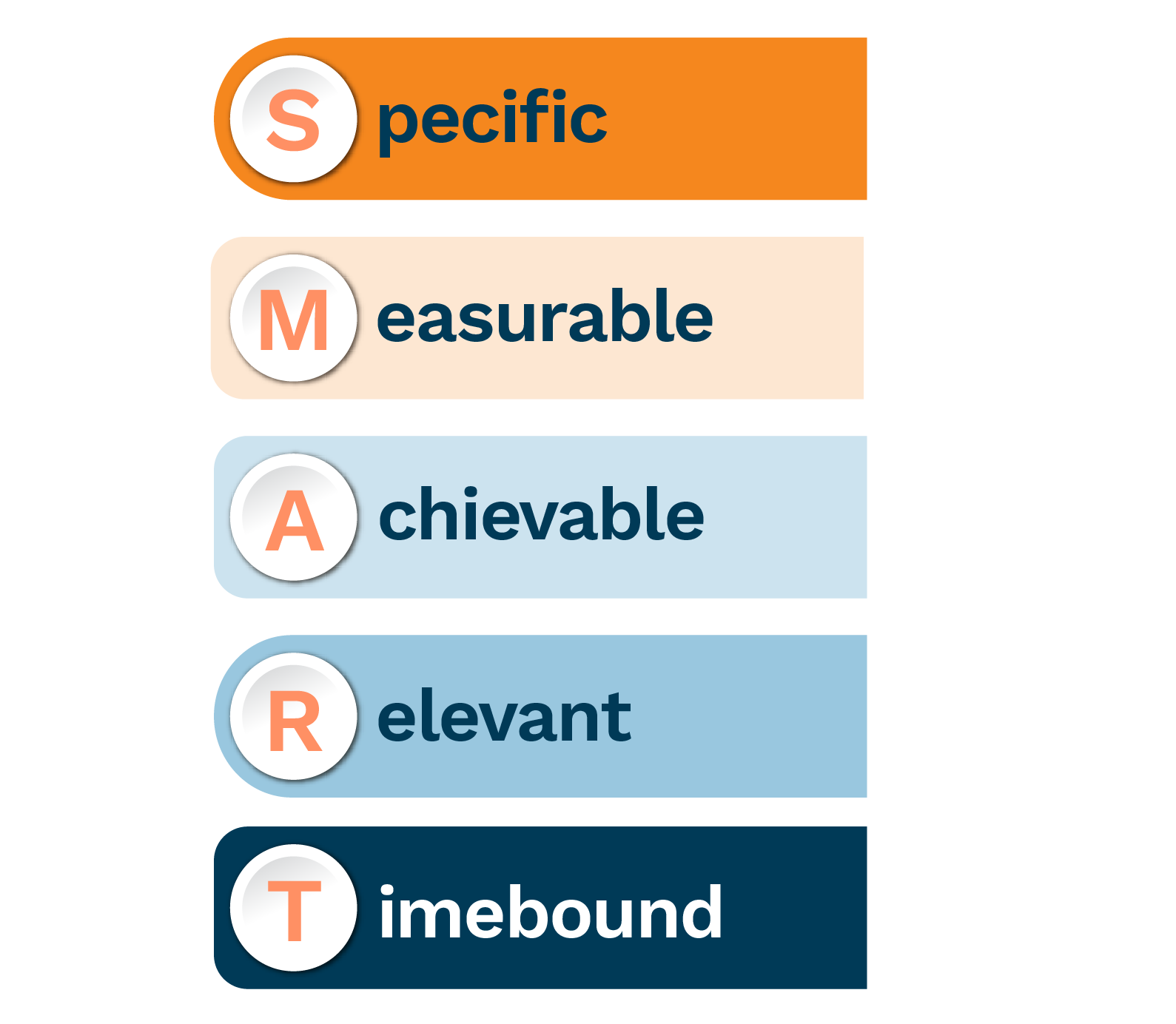

Step 1: Help your MDW set a S.M.A.R.T. goal

Specific: What does she want to achieve? It could be building up an emergency savings fund or buying a house in her homeland.

Measurable: How will she know when she has achieved the goal? Perhaps it’s when she has $4,000 in her savings account.

Achievable: Is the goal realistic and achievable? For example, she can meet the goal by regularly putting aside 30% of her income over several months.

Relevant: The goal should improve her life. For instance, setting up an emergency fund can give her greater peace of mind.

Timebound: Her goal should have a clear deadline. She could decide that her funds must be ready in 18 months.

Step 2: Help your MDW set a monthly savings goal

Now that she knows how much money she needs and when she needs it, she can set a monthly amount of money to attain that goal using a simple formula of

Amount to save each month = Total money needed ÷ Time in months

Encourage her to start small and grow her savings over time.

Step 3: Help her spend less

It’s important to teach your MDW about the difference between needs and wants to ensure that she spends within her means.

She will need to identify what are true needs and what are merely wants. Then she could reduce spending on wants each month until it’s possible to meet her monthly spending goal. Let her know that by spending less and saving more, she can reach her goal sooner, be it buying a house back home or paying off her debts.

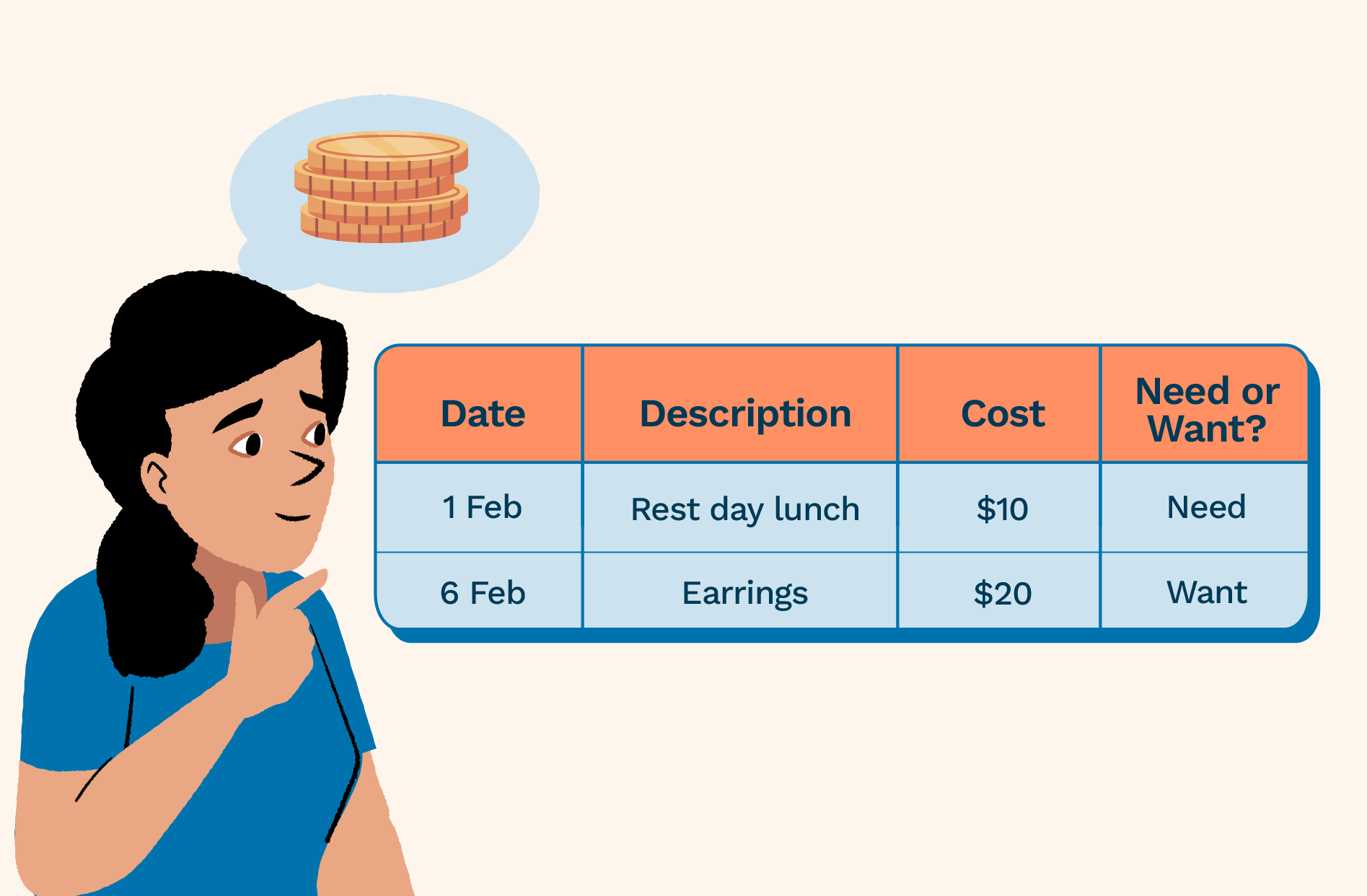

Step 4: Teach her how to keep records of her spending

Clear monthly records can help her with step 3. By staying on top of what she spends on (and how much), she will find it easier to adjust her spending. She can do this on the phone or on paper.

Step 5: Tell her how to set a budget

The final step is to set the amount of money that she can spend monthly.

(Money to spend) = (Her income) – (her monthly remittance) – (her monthly savings goal)

Tips and resources that can help her

- When she goes out during her rest day, she should only bring the amount of cash she has planned to spend to control her impulses.

- She should save up for big purchases instead of using instalment plans or buy-now-pay-later schemes which may incur high interest.

- She should keep her savings in a bank account so it’s harder for her to spend it.

- Tell her to get our easy-to-read money management guide, which is available in multiple languages!

- Aidha offers multiple money management courses for MDWs.

Discuss the importance of saving with her

To encourage your helper, let her know that the more she saves, the more prepared her family is for emergencies and unexpected situations like sudden illnesses or repair bills. These savings can also make important investments like a home or a future business possible, giving her greater financial security and potentially even fulfilling a lifelong dream!

Conclusion

Take time to check in with your MDW about her financial well-being. Find out her financial situation and offer guidance. This isn't just beneficial for her; it gives you peace of mind knowing that she is less likely to turn to UMLs or be vulnerable to loan scams.